Axis Long Term Equity Fund is open-ended, and an actively managed Equity Mutual Fund. As an actively managed Fund, the Fund Manager, Jinesh Gopani, has the liberty to dynamically change its investment composition to suit the prevailing market conditions and take advantage of opportunities arising in the market.

Axis Long Term Equity is an Equity Linked Saving Scheme (ELSS) that allow investors to claim deductions under Section 80C of the Income Tax Act, 1961, in order to reduce the tax liability for that Financial Year. Investors are restricted from redeeming their investments for a period of 3 years, as ELSS funds have a lock-in period.

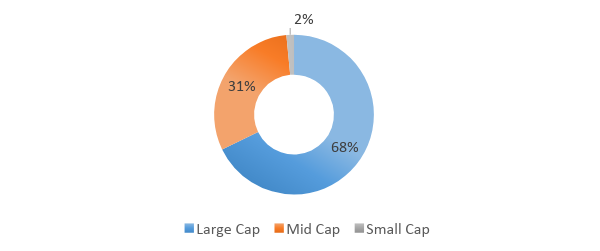

Axis Long Term Equity Fund predominantly invests in Large Cap Stocks, as a result of this strategy, the fund is exposed to the market volatility. However, the volatility of the fund is low when compared to funds with higher exposure to Mid Cap and Small Cap Stocks.

The consistency in generating alpha while stabilizing overall risk volatility has not only proven it to be as one of the best funds in ELSS segment but throughout the equity category. Even though the fund suffered a setback during the last couple of years, its strong fund management team and a well-proven investment mandate strengthen it fundamentally.

Investment Objective

The Investment Objective of Axis Long Term Equity Fund is to provide its investors with long-term capital appreciation and to generate income through systematic investments in Equity and Equity related instruments and Debt and other money market instruments.

Basic Fund Details

|

Fund Name |

Axis Long Term Equity Fund |

|

Fund House Name |

Axis Mutual Fund |

|

Launch Date |

29 Dec, 2009 |

|

Benchmark |

S&P BSE 200 TRI |

|

Scheme Category |

Equity |

|

Scheme Sub Category |

Equity Linked Savings Scheme (ELSS) |

|

Assets |

Rs. 18,852 (As of Mar 31, 2019) |

|

Expense Ratio (As of Mar 31,2019) |

Regular – 1.77% Direct – 0.84% |

|

NAV (Direct Plan) (As of May 09,2019) |

Growth – Rs. 46.2216 Dividend – Rs 36.1426 |

|

Minimum Investment |

Lumpsum Investment – Rs. 500 SIP Investment – Rs. 500 |

|

Exit Load |

0% |

|

Fund Manager |

Jinesh Gopani |

Asset Allocation

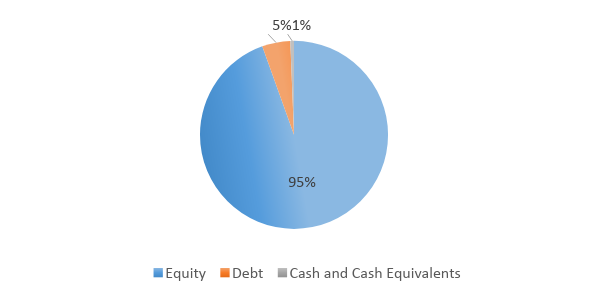

According to the mandate of Axis Long Term Equity Fund, the fund is required to invest a minimum of 80% of its assets in Equity and Equity related Instruments, and the remaining 20% will be invested in Debt and other Money Market Instruments. The asset allocation of the fund according to its mandate is as shown below:

|

Asset |

Minimum Allocation |

Maximum Allocation |

|

Equity and Equity Related Instruments |

80% |

100% |

|

Debt and other money market instruments |

0% |

20% |

The present asset allocation of the fund has been provided in the chart below.

Fund Asset Bifurcation (As of Mar 31, 2019)

Fund Equity Bifurcation (As of Mar 31, 2019)

Portfolio

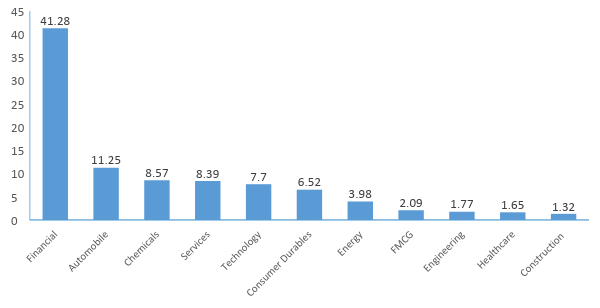

Axis Long Term Equity Fund is a diversified mutual fund that invests across sectors, primarily focusing on large-cap companies. The fund distributes its equity investments across 33 stocks of companies from various sectors.

The top 10 stocks of the company make up 61.97% of its equity investments. The fund seeks to invest in companies that demonstrate sustainable business practices, efficient capital allocation, and other operational efficiencies.

The sectoral allocation of the fund has been provided in the chart below.

Fund Sector Allocation (As of Mar 31, 2019)

Top 10 Holdings (As of Mar 31, 2019)

|

Name of the Company |

Sector |

Investment Percentage |

|

HDFC Bank |

Financial |

8.20% |

|

Bajaj Finance |

Financial |

8.03% |

|

Kotak Mahindra Bank |

Financial |

7.87% |

|

Tata Consultancy Services |

Technology |

7.70% |

|

Pidilite Industries |

Chemicals |

7.21% |

|

Gruh Finance |

Financial |

5.11% |

|

Avenue Supermarts |

Services |

4.75% |

|

Maruti Suzuki India |

Automobile |

4.58% |

|

HDFC |

Financial |

4.54% |

|

Torrent Power |

Energy |

3.98% |

Performance

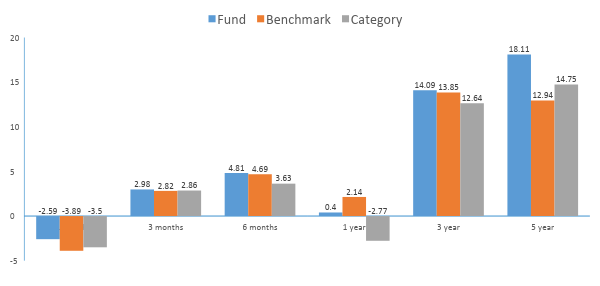

Axis Long Term Equity Fund was launched in December 2009 and has almost consistently outperformed its benchmark and category since its inception. The fund saw its best performance between September 2013 and September 2014.

The fund carries an Alpha of -0.16 which is higher than the category average of -1.44, the fund also carries a Beta of 0.94 which is marginally lower than the category average of 0.96. The Alpha and Beta of the fund demonstrate the fund’s ability to produce higher-than-expected returns while providing good stability.

The fund produces good returns in bullish markets and mitigates losses well during bearish market cycles. The fund performs best in investment cycles of 5 years.

The trailing returns of the fund against its category and benchmark have been provided in the chart below:

Fund Manager

Jinesh Gopani has been managing the fund since 1st April 2011. He has a total experience of 17 years in the Financial Markets. Prior to joining Axis Asset Management Company, he has worked with Birla Sun Life AMC, Voyager India Capital Pvt. Ltd., Emkay Shares & Stock Brokers Limited and Net worth Stock Broking Limited.

Jinesh Gopani manages 5 Mutual Funds for Axis AMC.

-

Axis Long Term Equity Fund – Since April 2011

-

Axis Focused 25 Fund – Since June 2016

-

Axis Emerging Opportunities Fund Series 1 (1400 Days) – Since Dec 2016

-

Axis Emerging Opportunities Fund Series 2 (1400 Days) – Since Feb 2017

-

Axis Growth Opportunities Fund- Since Oct 2018